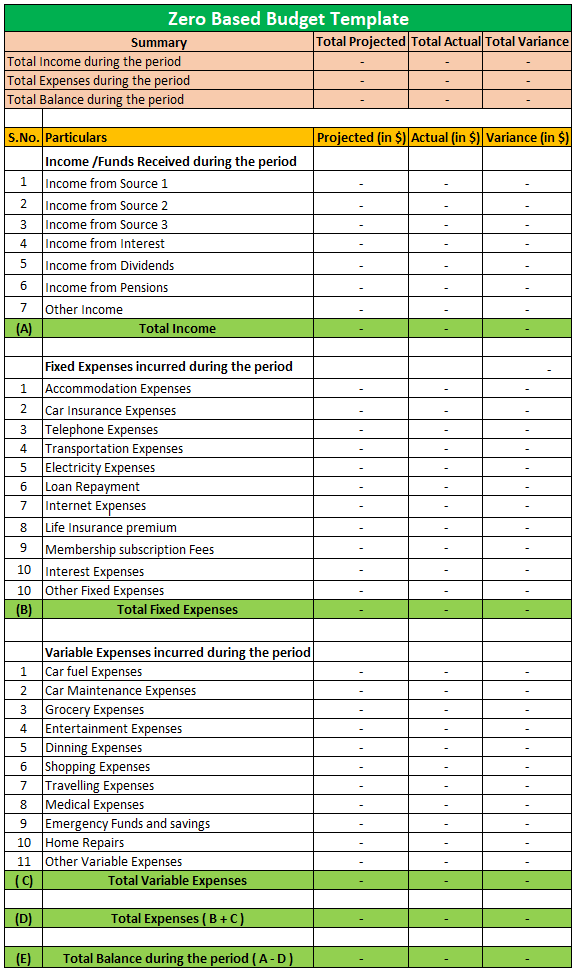

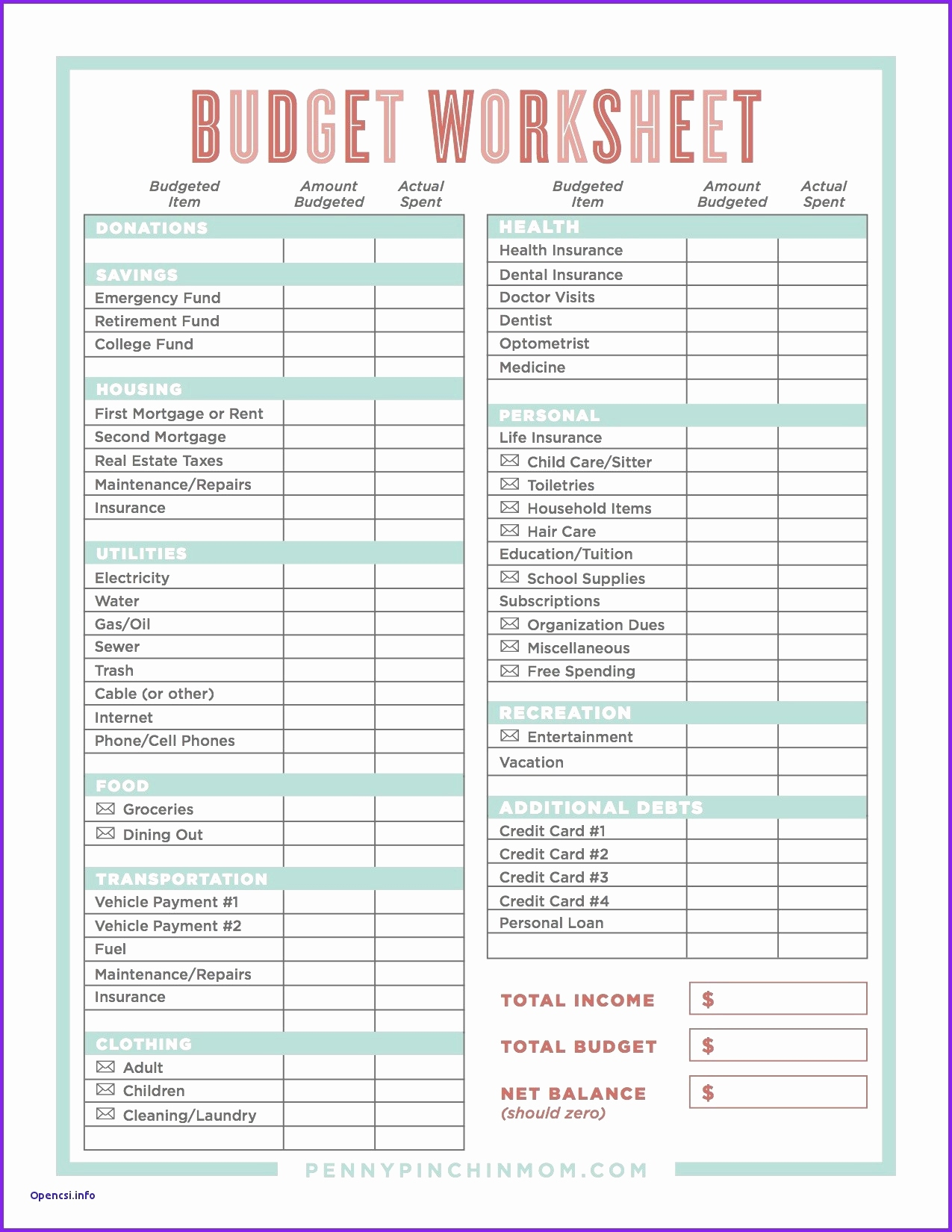

If you want to save for a new car, for example, add a dedicated savings bucket to your monthly budget to make that happen. Identify all of your expenses - including debt payments, needs and wants, an emergency fund, and any savings goals. Zero-based budgeting can help you allocate every dollar of your income - but before you begin that allocation, you’ll need to create expense buckets. As you tune into your spending habits, look for places where you can cut back and areas where you’d like to dedicate more money, like an emergency fund. You may find it helpful to use a personal spending tracker worksheet. From there, begin closely tracking your expenses for a few months. Start by reviewing receipts or card statements and note how you spend your money. If you haven’t kept a close eye on your spending in the past, it can be tough to understand where your money really goes on a monthly basis.

When you start fresh each month, you can base your budget off of your estimated monthly income and create a more accurate projection. For those with variable income, this is where zero-based budgeting comes in handy.

#Zero based budgeting personal full

Be sure to include paychecks for full or part-time jobs along with any benefits like alimony and child support. Start by adding up all of your sources of monthly income. This can be an intimidating task - but breaking it down into the following steps can help. Zero-Based Budgeting Stepsīefore implementing a zero-based budget, you’ll need to take an honest look at your financial situation. While it’s a great budgeting tactic for financial hardship, zero-based budgeting is also particularly helpful for anyone with a variable income, or those who may simply need to take a closer look at their personal spending habits. For example, if you spent less than anticipated on groceries last month, you should put those dollars toward your savings fund. Of course, you can use the previous month to help you estimate where your income will go. Each month, you start from scratch and create a new budget. Zero-based budgeting is a budgeting method that encourages you to account for every dollar of your monthly income.

Whether you’re budgeting with a variable income, simply trying to get a better grip on your personal spending, or need to adjust your budget after job loss, a strategy called zero-based budgeting can help you ensure that you make the most out of every dollar. When money is tight, your budget should be even tighter. Whether you’ve managed your money for years or you’re a budgeting novice, learn how zero-based budgeting can help you make every dollar count.

0 kommentar(er)

0 kommentar(er)